Life insurance can do more than pay the bills; it can help pay for tuition or help you live well in retirement, too.

In Canada, there are many different types of insurance: automobile insurance, home insurance, and life insurance to name just a few. Insurance is like a safety net you’ve paid into that will safeguard your financial assets (your home and investments, for example) and income, and keep you and your loved ones from debt should anything unexpected happen.

When it comes to protecting the life and health of Canadians, there are basically five types of insurance:

Life insurance is the most common and most well-known, but each of these types of insurance serves a purpose.

Life insurance is basically a contract that pays your beneficiary a tax-free lump sum when you die.

The money may be used to pay off debt, put kids through school, replace income, supplement retirement savings, give money to a charity, or even pay taxes.

In the end, it helps your beneficiary go on without financial hardship.

Check out this great glossary of insurance terms.

Life insurance isn’t for the person insured; it’s for their family, dependants, loved ones or others they care about. Almost everyone might need life insurance, including:

Determining how much life insurance you need can be very complex. In simple terms, it depends on a few key factors, including:

It’s important to complete a financial needs analysis before taking out life insurance so you have a good idea how much to buy. Then, compare the cost of this level of coverage to how much you can afford.

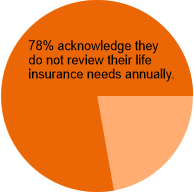

80% of consumers overestimate the cost of life insurance.

Try this simplified financial needs analysis to assess your need for life insurance.

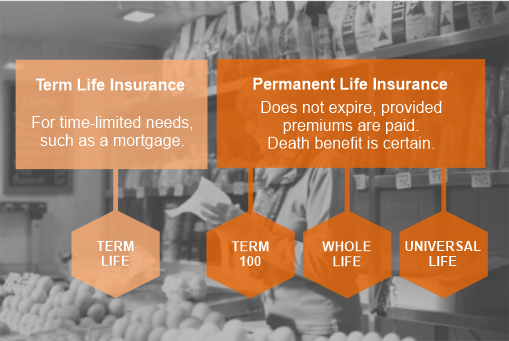

Broadly speaking, there are two types of life insurance available in Canada:

Term life insurance pays a death benefit if the person insured dies within a given time period. That time period may be either:

If you die during the given time period, your beneficiary receives a death benefit payment. The insurance coverage ceases, however, once the time period expires. Death after this point means your beneficiary would not receive a death benefit payment.

Typically, your insurance provider will fix your premiums when your contract is issued. These premiums would increase at every renewal of the term, whether that’s every five, 10 or 20 years, for example. Premiums are due for the entire length of the coverage. If you fail to pay your premiums, your coverage may be cancelled.

Term insurance is excellent for replacing the deceased’s income, paying off mortgages and debts, funding a child’s post-secondary education, or supplementing a survivor’s retirement because these needs have a finite time period that is often known.

Unlike term insurance, permanent life insurance does not expire after a given period of time. In fact, you may keep the coverage as long as you live, provided the premiums are paid. For that reason, permanent life insurance premiums are generally more than term life insurance premiums.

Permanent insurance policies may also build up a cash value within the policy. That means you can get cash back on the policy, borrow against the policy, or invest the cash within the policy. The different types of permanent insurance offer slightly different features and benefits, depending on your needs.

Permanent life insurance provides the opportunity to transfer wealth tax-efficiently from one generation to another, pay income taxes upon death, or provide a legacy. It is also the best way to insure a child and ensure they have live insurance coverage for life.

Use this simple tool to find out how much life insurance may cost. This cost has to balance with what you can afford. There are ways to maximize your coverage while minimizing your cost. As with all financial products and solutions, please contact a financial advisor before purchasing life insurance.

Before buying life insurance – even before making a final decision – you should talk to a licensed financial advisor. Many financial advisors and life insurance agents offer free life insurance advice; it doesn’t cost you anything to talk to a professional before making your decision.

Penta Wealth is a full-service financial advisory firm licensed to advise on and sell life insurance. We’ve been helping Canadians build, protect and enjoy their wealth for over 17 years. Our advice is free, so talk to an advisor and let us help you find a life insurance solution that meets your needs and your budget. We work with some of Canada’s biggest, strongest and most innovative life insurance companies, including:

Penta Wealth is a full-service financial services company, offering its clients traditional and sustainable investment solutions, a full shelf of insurance solutions, plus complete financial planning, including retirement planning, tax planning and estate planning.

STAY INFORMED!

Get our industry updates & tips delivered

directly to you.

Portfolio management services provided by R N Croft Financial Group Inc., a licensed Portfolio Manager and Investment Fund Manager serving individual and institutional clients throughout Canada.

© 2024 PENTA WEALTH | PRIVACY POLICY | LEGAL

BA, BEd, MBA, RWM

A former high school teacher and college Economics lecturer, Scott Boassaly has always valued education. This is further illustrated by his formal education. He holds a BA in History from Carleton University, a Bachelor of Education from The University of Ottawa, and an MBA from The University of Ottawa. This focus on education reveals itself in his approach to financial advice and in his commitment to offering free financial seminars to both adults and children. Celebrating his 20th anniversary as a wealth manager, Scott started his career at a large national firm where he quickly transitioned into management. Further industry experience was gained working with a reputable brokerage, then managing his own brokerage, Balance Financial, since 2019. Scott is the only certified responsible investment advisor in Ottawa and also holds the Real Wealth Manager designation.